All Categories

Featured

Table of Contents

Rate of interest will be paid from the date of fatality to day of payment. If death results from natural causes, fatality proceeds will be the return of premium, and rate of interest on the premium paid will certainly be at a yearly effective rate specified in the plan contract. Disclosures This policy does not assure that its proceeds will be sufficient to spend for any kind of certain solution or product at the time of requirement or that services or goods will be provided by any kind of certain carrier.

A full declaration of coverage is discovered just in the plan. Returns are a return of costs and are based on the actual death, cost, and investment experience of the Firm.

Long-term life insurance policy establishes money worth that can be borrowed. Plan financings build up passion and unpaid policy fundings and passion will certainly lower the fatality benefit and money worth of the policy. The quantity of money value offered will typically depend on the sort of long-term plan bought, the quantity of coverage purchased, the length of time the policy has been in force and any type of impressive policy lendings.

Our viewpoints are our own. Burial insurance policy is a life insurance coverage policy that covers end-of-life expenses.

Interment insurance coverage requires no clinical examination, making it easily accessible to those with medical conditions. This is where having burial insurance policy, additionally understood as final expense insurance policy, comes in convenient.

Streamlined concern life insurance needs a wellness analysis. If your health condition invalidates you from traditional life insurance policy, interment insurance might be an option.

Sell Funeral Plans

Compare affordable life insurance policy options with Policygenius. Term and irreversible life insurance, burial insurance is available in numerous types. Have a look at your coverage choices for funeral service expenses. Guaranteed-issue life insurance policy has no wellness needs and provides fast approval for coverage, which can be useful if you have severe, incurable, or multiple health problems.

Streamlined issue life insurance coverage does not require a clinical examination, however it does need a wellness survey. So, this policy is best for those with mild to modest health and wellness problems, like high blood stress, diabetes, or bronchial asthma. If you don't desire a medical examination but can get approved for a simplified problem policy, it is typically a far better bargain than an assured issue plan due to the fact that you can obtain even more protection for a less expensive costs.

Pre-need insurance policy is dangerous because the beneficiary is the funeral home and insurance coverage specifies to the picked funeral home. Should the funeral home fail or you move out of state, you might not have insurance coverage, and that beats the function of pre-planning. Furthermore, according to the AARP, the Funeral Service Consumers Partnership (FCA) discourages buying pre-need.

Those are basically interment insurance coverage policies. For assured life insurance policy, costs calculations depend on your age, gender, where you live, and coverage amount.

Burial Life Insurance Policies

Interment insurance offers a simplified application for end-of-life protection. Many insurance coverage companies need you to talk to an insurance policy agent to apply for a plan and obtain a quote.

The goal of having life insurance policy is to ease the problem on your enjoyed ones after your loss. If you have a supplementary funeral service policy, your liked ones can make use of the funeral plan to deal with final costs and get an immediate dispensation from your life insurance policy to take care of the mortgage and education costs.

Individuals that are middle-aged or older with clinical conditions might take into consideration funeral insurance, as they might not get standard policies with stricter authorization standards. In addition, interment insurance policy can be valuable to those without extensive financial savings or standard life insurance policy coverage. cost burial insurance. Burial insurance policy varies from other sorts of insurance coverage in that it uses a lower survivor benefit, generally only adequate to cover expenses for a funeral and other associated costs

ExperienceAlani is a previous insurance coverage fellow on the Personal Financing Insider team. She's assessed life insurance and pet insurance policy companies and has written numerous explainers on traveling insurance, credit, debt, and home insurance.

Average Final Expense Cost

The even more insurance coverage you obtain, the higher your costs will certainly be. Final expense life insurance policy has a variety of benefits. Specifically, every person that uses can obtain accepted, which is not the instance with other kinds of life insurance policy. Last expense insurance is usually recommended for seniors who might not get standard life insurance coverage due to their age.

In addition, final cost insurance is valuable for people that intend to pay for their very own funeral. Funeral and cremation solutions can be pricey, so last expenditure insurance policy gives tranquility of mind understanding that your liked ones won't have to use their cost savings to spend for your end-of-life plans. Last cost insurance coverage is not the finest product for everybody.

Obtaining entire life insurance through Ethos is fast and easy. Coverage is available for elders between the ages of 66-85, and there's no medical exam called for.

Based on your responses, you'll see your approximated rate and the quantity of coverage you get approved for (in between $1,000-$ 30,000). You can buy a policy online, and your insurance coverage starts quickly after paying the initial costs. Your price never ever transforms, and you are covered for your whole life time, if you proceed making the monthly repayments.

Funeral Cost Insurance Policy

Last cost insurance coverage supplies advantages yet needs careful factor to consider to establish if it's right for you. Life insurance can attend to a range of financial needs. Life insurance for final costs is a sort of long-term life insurance policy designed to cover expenses that occur at the end of life - compare funeral insurance plans. These plans are fairly simple to get, making them excellent for older people or those that have health issues.

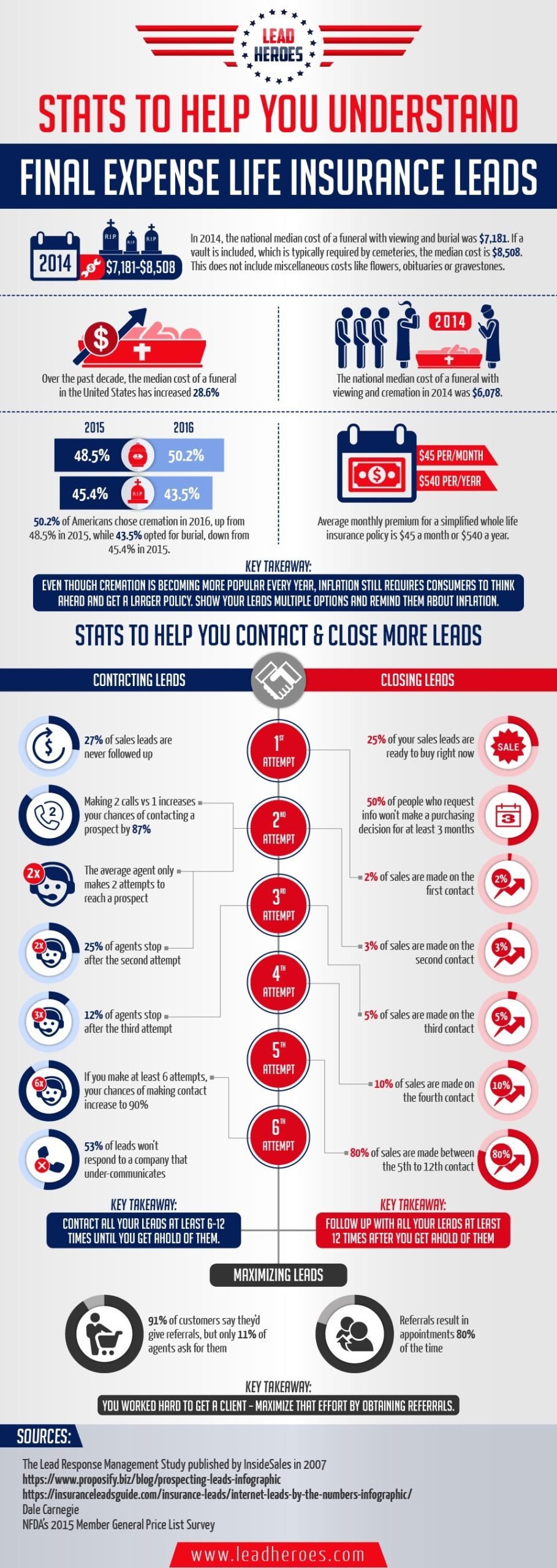

According to the National Funeral Directors Organization, the average cost of a funeral service with funeral and a viewing is $7,848.1 Your loved ones might not have accessibility to that much cash after your fatality, which could include in the tension they experience. Additionally, they might come across various other expenses connected to your passing away.

Final expense protection is sometimes called burial insurance, but the cash can pay for practically anything your liked ones require. Beneficiaries can use the death benefit for anything they require, allowing them to resolve the most important economic priorities.

: Hire specialists to assist with taking care of the estate and browsing the probate process.: Close out make up any kind of end-of-life treatment or care.: Repay any various other debts, including auto finances and credit scores cards.: Recipients have complete discretion to use the funds for anything they require. The money might also be utilized to create a tradition for education and learning expenses or donated to charity.

Latest Posts

Burial Policy Prices

Burial Policy Cost

Funeral Cost Insurance